CHAPTER 1: INTERACTIVE FTS

CASES

Interactive FTS

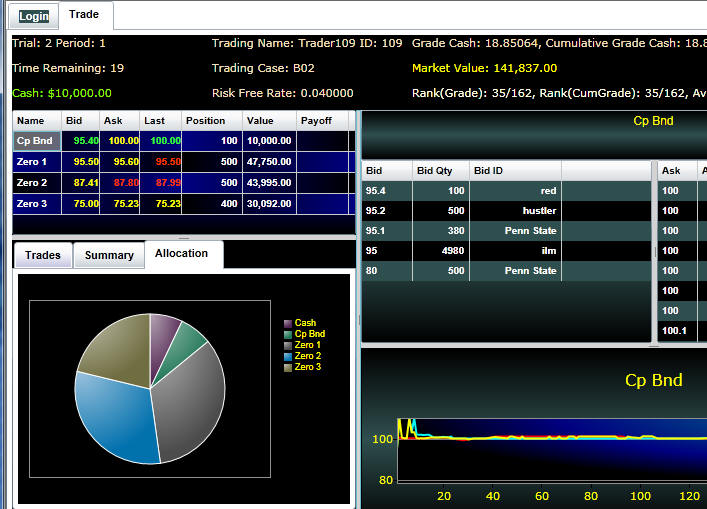

In an interactive FTS trading exercises you are part of the market's

trading crowd. You learn how to apply the concepts in

BondTutor from personal trading experience. In each FTS trading case the learning objectives are tied

to the price discovery problem. For example, the initial cases

emphasize the time value of money and market microstructure. The

Trading Screen Market Microstructure: The problem facing the market is to discover

the prices of these two securities as the market moves through time

with three trading periods. Period 1 is day 1 of year 1,

Period 2 is day 1 of year 2, and Period 3 is day 1 of year 3.

Trading is under the rules of the continuous

double auction institution. That is, unfilled bids are

continuously ranked from highest to lowest in the market book and

unflilled Asks are continuously ranked from lowest to highest in the

market book. There are three types of trades supported: 1. Market making limit order. For

this order you submit a Bid to buy some quantity at your specified

price or an Ask to sell some quantity at your specified price.

This order type appears in the book in the top RHS of the above

screen dump. 2. Market order. For this order

you are a market taker and submit a quantity to buy from an existing

Ask or sell to an existing Bid. The latest Market order

transaction appear under last in the top LHS of the above screen

dump. 3. Market limit order. For this

order you are a market taker and you submit a limiting price

and a quantity. That is, for a market limit buy order you are

attempting to buy from the best Ask so long as it is not higher than

the price you submit. A market limit sell order attemtps to

sell to best Bid so long as it is not lower than the price you

submit. This would also appear under Last in the above screen

dump if a market limit order was the most recent transaction. In the above you can be either of two types

of traders. A market maker who attempts to earn the spread but

cannot control execution, or a market taker who pays the spread but

controls execution. In the real world the market makers are

the primary dealers who can make market in Government securities. Long and Short Positions Your current position in a security appears as

either a positive or negative number under Position in the above

screen. Suppose you buy 10 coupon bonds and

hold them then at the end of each year your cash account is credited

with 10*$Coupon payment and at the end of .three year's you receive

10*$Coupon payment + 10 *Face Value. Each period the cash

earned will earn interest in your money market. At the time of

purchase your money market cash amount is reduced by 10*Purchase

Price. You can also sell bonds that you do not own!

This is known as short selling. Suppose you short 10 bonds you

do not currently own and maintain this short position.

Now you receive in your cash account 10*$Selling price but at the

end of each year you must cover the cash payments from the 10-bonds.

That is,at the end of year 1 10*$coupon payment is subtracted from

your account, etc., and at end of year 3 (10*$coupon payment +

10*$Face Amount) is automatically subtraqcted from your money market

account. If you are short any security then under

Positions above this would displayed as a negative number. In your money market account you can borrow

or lend and if you borrow you pay the money market rate in interest

at the end of each year and vice versa if you lend. By running through the interactive demo above

you will get to experience the actual dynamics of the market.

Exercise 1:

Trading Case B01

Case Objective

To understand the time value of money;

to understand the cash flows from coupon and zero coupon bonds; to

apply the discounting formula to value such bonds. To master the operational details associated

with trading bonds in a continuous double auction institution -- the

form used in the real world secondary trading markets. The

Primary dealers are the market makers and the retail general

investing public are the market takers. In this case you get

to play both roles -- Primary dealer as well as retail investor.

Key Concepts

Time value of money; discounting;

determining bond prices given interest rates. Textbook Integration:

Background Reading

Section 1.2 Present Value and inparticular

read the Three Period Example. In B01 this type of financial

problem faces the trading crowd in a market. That is, traders

are buying and selling fixed income securities with the objective

making money. In the next chapter of Bond Tutor you will

learn the finer points

associated with bond pricing.

The rules that govern trading in the market are

referred to as the market microstructure and these rules are

briefly described above and for additional details click on

market microstructure.

. Instructor References for the FTS

Interactive Markets Instructors can contact

ftsweb@gmail.com for additional

details regarding how you can get your class up and running with B01

and related bond trading cases.

Overview of FTS Interactive Markets

To get going (using either a Windows PC or a Mac) click on:

Important Note: To run the FTS Interactive Trader you need port

number 4502 open. If your firewall blocks this port then you

will need to skip this next link.

Once the FTS Interactive trader is loaded click on the button

"Connect to Demo."

Note: The demonstration trading case is B02 which is

introduced in Chapter 2, section 2.6 titled Interactive Cases.

This demonstration illustrates the screen elements, the market

microstrucutre as well as the dynamics of a FTS interactive trading

exercise.

Schools can contact ftsweb@gmail.com

for details as to how to get your classes up and running and

competing in a rice discovery trading exercise.

office (412)

9679367

office (412)

9679367

email: ftsweb@gmail.com

toll-free 1 (800) 214-3480